Accelerate Financial Consolidation & Reporting Cycles

Financial consolidation is a mission-critical process that involves collecting and consolidating sensitive financial information. Consolidation with Planful accelerates month-end close cycles, empowers finance with robust financial and regulatory reporting, and provides a single trusted source of financial truth.

Key Advantages

Key Features

Out-of-the-box journal entries and reclassifications

Post journal entries and process account reclassifications with built-in financial logic that automatically accounts for debits and credits, MTD and YTD balances, currency types, and assets, liabilities, revenues, and expense account properties. Since journal entries and reclassifications come out of the box, you don’t need to know any complex coding or depend on expensive consultants to automate your monthly consolidation process.

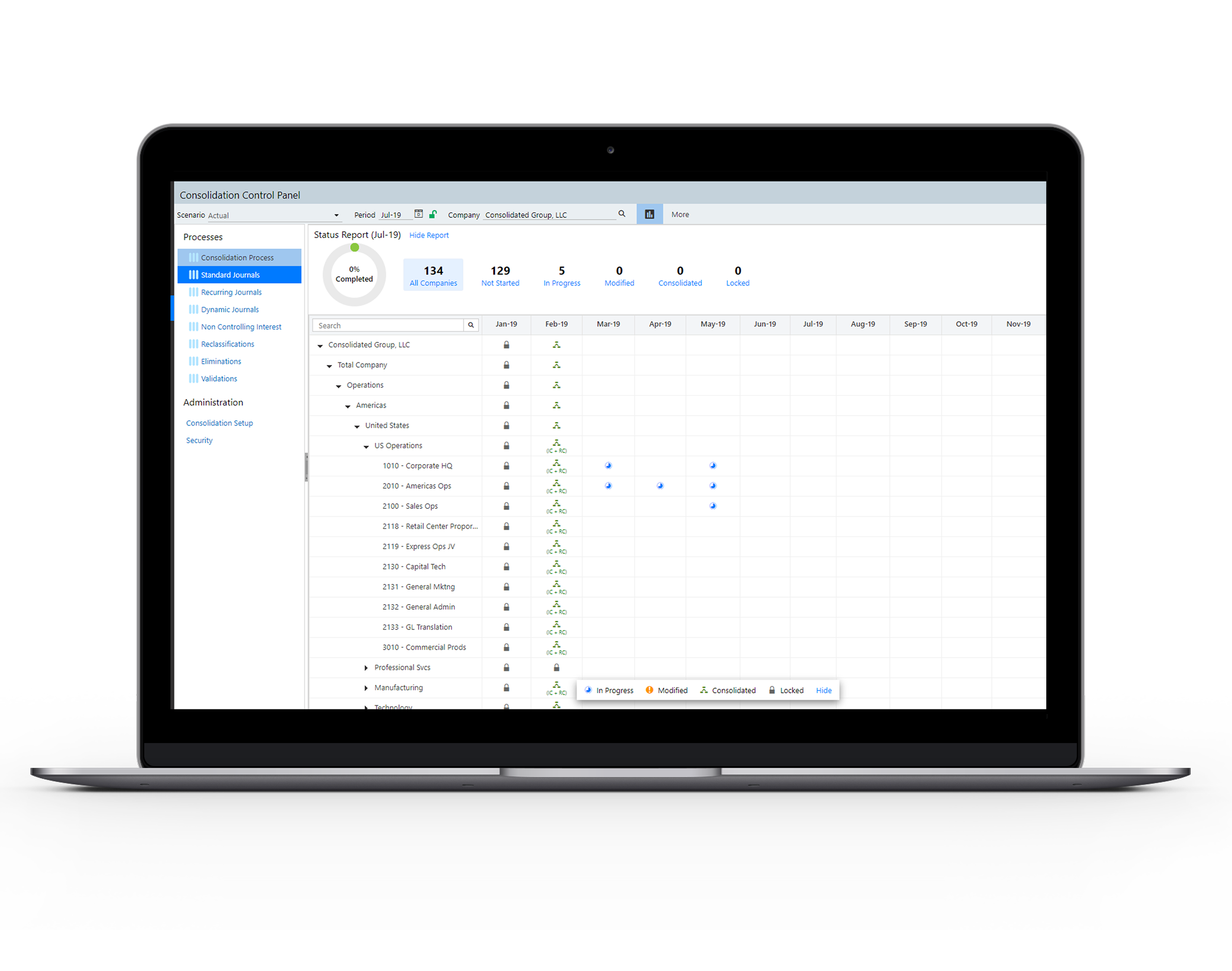

Built-in workflow

Know where you are in the close process at all times with Workflow. Located in the Consolidation Control Panel, Workflow provides a visual snapshot of who and what work is completed, and what work is yet to be done. See which entities have submitted and validated trial balances, completed inter-company eliminations, and processed their consolidations.

Simply support complex corporate structures

Automate all of your critical close activities from multiple ERP systems in Planful. With Planful, you can map all your entities to a single chart of accounts for consistent global reporting across the entire organization.

Flexible financial reporting

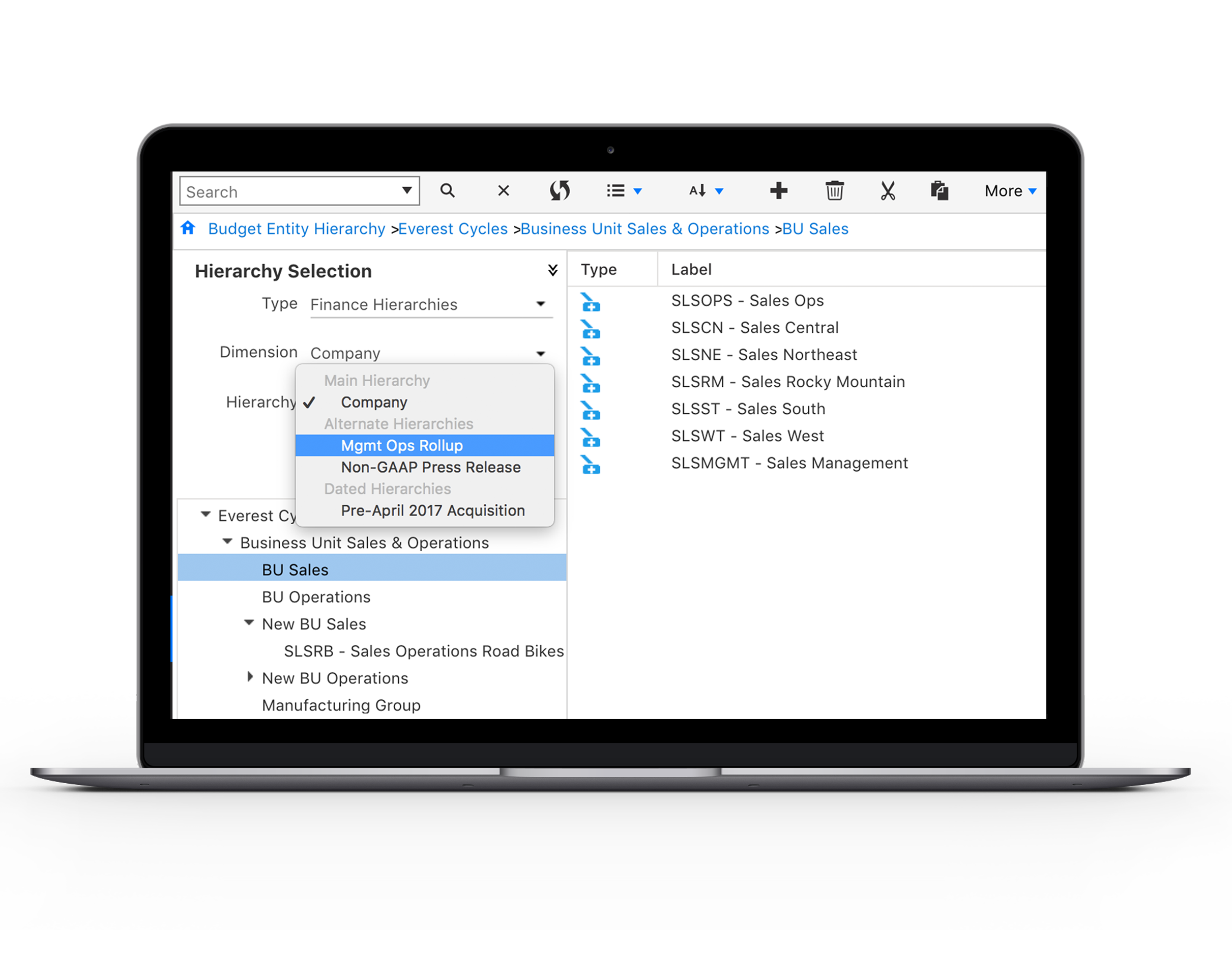

Report financial results using alternate hierarchies or org-by-period hierarchies so that you can see and validate business performance in the views that are meaningful to your business leaders. Customize fiscal year end dates based on how and when you close the books.

Additional Features

Built-in GAAP & IFRS support

All activities, workflows, and statutory financial statements conform to the latest global accounting standards. Built-in and configurable layouts for Balance Sheets, Income Statements, Statements of Cash Flows. Publish reports in EDGAR-compliant HTML and XBRL formats for regulatory reporting.

Currency conversion

Consolidate, translate, and report foreign currency in accordance with the latest standards and leverage foreign currency rate data feeds. Incorporate currency exceptions with a single click. Review foreign exchange rates and let the platform calculate currency conversion and CTA, automatically.

Automatic data refresh

Quickly load summary balance or transaction-level data from any general ledger, ERP, or other business system . Take your process to the next level by automating the data connections from your ERP and other source systems directly to Planful platform.

Security and audit trails

Strong internal controls and security ensure that only authorized users can access designated areas. Audit logs and reports are searchable and provide transparency into what adjustments were made and by whom.

Best Practices in Financial Consolidation

Learn to modernize your financial consolidation & reporting process and evaluate modern finance solutions.

4 Tips to Achieve the Elusive Zero-Day Close

Learn the steps your organization can take to reduce your time to close from weeks to a matter of days with a well-configured FP&A platform.